Hebron Savings Bank understands the importance of privacy, confidentiality, and integrity.

Online Banking ID and Password

Password Lock-Out

Automatic Log-off

Browser Security

How You can Protect Your Internet Security

- Keep your Online Banking password to yourself.

- Change your password frequently.

- Remain at your computer until your Online Banking transactions are completed and log out when you are finished.

- Log out of Online Banking prior to visiting other Internet sites.

- Lock your PC or mobile device with a password. This is your first line of defense against intruders.

- Avoid public Wi-Fi's when accessing your Online Banking account or other sensitive data.

- If you notice suspicious or unusual activity on your Online Banking accounts, call our Customer Care Center during regular business hours at (410)749-1185.

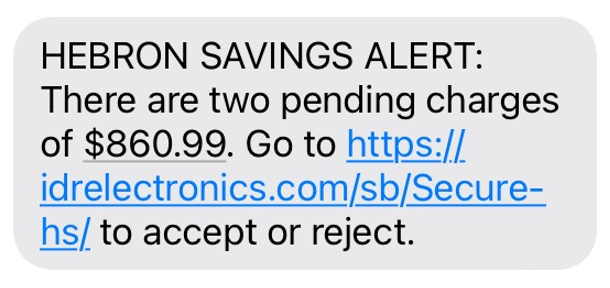

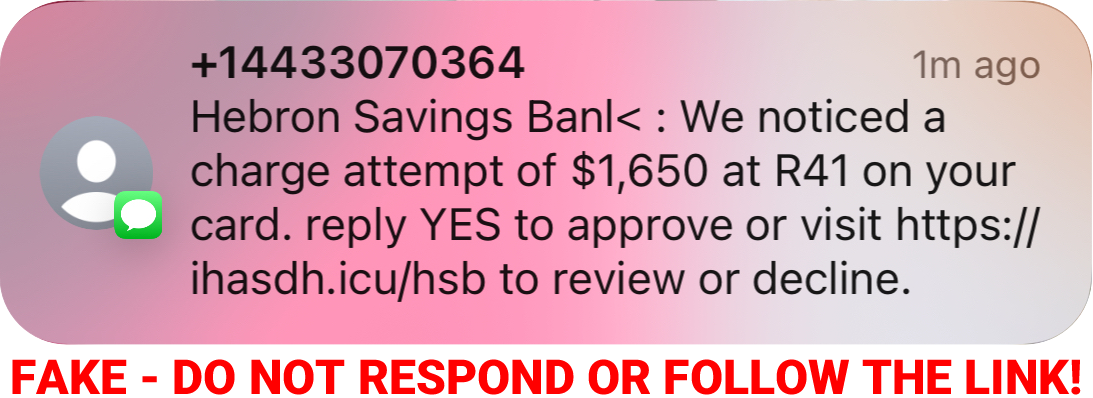

Special Alerts

We are seeing an increase in fraudulent debit card transactions involving Facebook and MetaPay. Fraud often begins with a $0 test transaction. These may appear under merchant names such as FACEBK*X4ZHY8RT72 or METAPAY*ST4R. In most cases, customers receive a legitimate automated fraud alert from Hebron Savings Bank asking for a response as to the validity of this charge. Marking a $0 transaction as “valid” may seem harmless because it is not a negotiable amount, but this authorization could allow additional transactions from the same merchant to process, sometimes up to $1,000.

Please do not respond “valid” to any fraud alert unless you are certain you personally initiated the transaction—even if the amount is $0.

If you receive any alert that you do not recognize or are unsure about, contact our Customer Care Center at 410-749-1185 or call the number on the back of your debit card immediately.